Best Investment Options in India: Real Estate vs Stock Market vs Mutual Funds vs Gold

Choosing the best investment options in India is crucial for anyone looking to grow their wealth safely and efficiently. With multiple choices like real estate, stock market, mutual funds, and gold, investors often struggle to identify which asset will give them the highest returns. This guide explains the best investment options in India and helps you decide where to invest based on your financial goals, risk tolerance, and investment horizon.

Understanding the best investment options in India is essential for both beginners and experienced investors. With the right strategy, you can maximize returns and minimize risk, ensuring a secure financial future.

Why the Best Investment Options in India Matter

Investing wisely can help you beat inflation, create long-term wealth, and protect your hard-earned money. The best investment options in India provide different benefits—some offer stability, while others promise higher returns. By knowing which option suits your financial goals, you can make smarter decisions and grow your portfolio effectively.

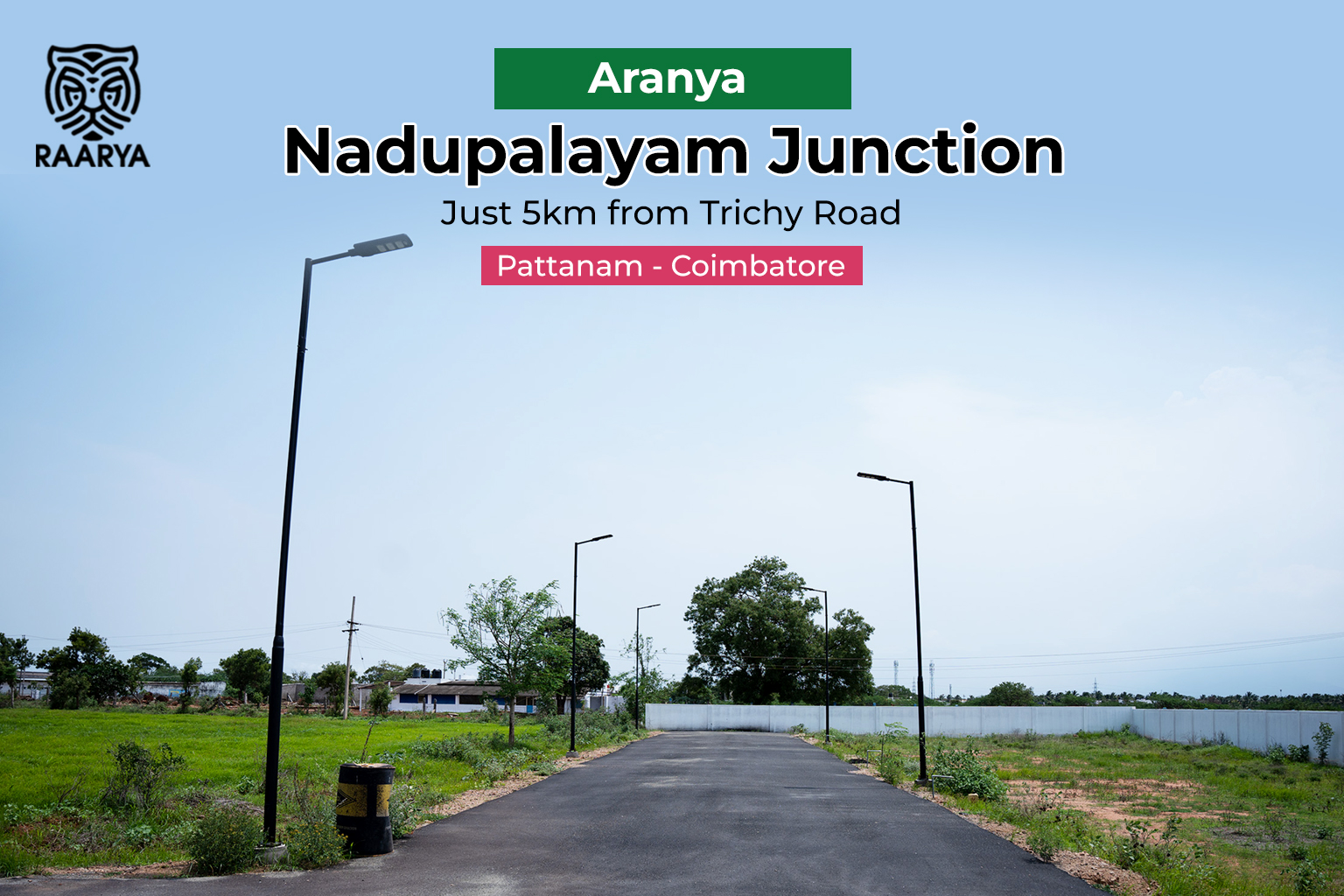

1. Real Estate – A Stable Choice Among the Best Investment Options in India

Real estate has long been considered one of the best investment options in India. Property investment not only gives you ownership of a tangible asset but also provides long-term capital appreciation and potential rental income.

Advantages of Real Estate

High potential for long-term appreciation

Steady rental income

Tangible and secure asset

Strong hedge against inflation

Disadvantages

Requires high initial investment

Low liquidity

Maintenance and legal costs

Investing in property, particularly in growing cities, makes real estate one of the best investment options in India for long-term financial security.

2. Stock Market – High Returns but Higher Risk

The stock market is often seen as one of the best investment options in India for investors seeking higher returns. While stocks are more volatile, disciplined investing and long-term holding can result in substantial wealth growth.

Advantages of Stock Market Investment

High growth potential

Easy to buy and sell

Suitable for long-term wealth creation

Tax benefits on long-term capital gains

Risks

Market volatility

Requires knowledge and analysis

Emotional decisions can affect returns

For those willing to accept risk, stocks are an essential component of the best investment options in India.

3. Mutual Funds – Beginner-Friendly Among the Best Investment Options in India

Mutual funds are considered one of the best investment options in India for beginners and salaried individuals. With professional fund management and portfolio diversification, mutual funds allow investors to grow wealth systematically.

Benefits of Mutual Funds

Professionally managed investments

Diversification reduces risk

SIP (Systematic Investment Plan) encourages regular investing

Suitable for long-term financial goals

Drawbacks

Market-linked risks

Management fees

Returns are not guaranteed

Mutual funds remain one of the best investment options in India for those seeking consistent growth without actively managing investments.

4. Gold – Safe Haven Among the Best Investment Options in India

Gold is a traditional investment and one of the best investment options in India for wealth protection. While gold may not offer high growth, it provides stability during uncertain economic times.

Advantages

High liquidity

Inflation hedge

Portfolio diversification

Safe-haven asset

Disadvantages

Low long-term returns

No regular income

Storage and making charges

Including gold in your portfolio makes it safer and balances risk, complementing other best investment options in India.

Comparison of the Best Investment Options in India

| Investment Type | Return | Risk | Liquidity | Best For |

|---|---|---|---|---|

| Real Estate | High (Long-term) | Medium | Low | Stability & asset creation |

| Stock Market | Very High | High | High | Aggressive investors |

| Mutual Funds | Moderate-High | Medium | High | Beginners & disciplined investing |

| Gold | Low-Moderate | Low | High | Wealth protection |

This table shows why combining multiple best investment options in India is a smart approach for diversification.

Which Are the Best Investment Options in India for You?

Your choice of investment depends on your:

Age and income

Risk tolerance

Investment horizon

Financial objectives

Suggested Strategy

Real estate for long-term security

Mutual funds for steady growth

Stocks for higher returns

Gold for risk protection

By combining these best investment options in India, you can reduce risk and maximize returns while building a strong, diversified portfolio.

Conclusion: Invest Wisely in the Best Investment Options in India

There is no single answer to the question of which is the best investment. However, a smart investor will mix real estate, stock market investments, mutual funds, and gold to create a robust portfolio. These best investment options in India, when chosen strategically, ensure long-term wealth growth and financial stability.

Always remember, choosing the right combination of the best investment options in India is key to achieving your financial goals efficiently.